Digital Scarcity Only Happens Once

Bitcoin is the kind of finality the world’s monetary experiments have always yearned for and rarely attained. All the alternatives that follow, no matter how ingeniously conceived or lavishly funded, echo like shadows against the cave wall of that first, singular breakthrough.

Welcome to BitcoinFi Weekly. We cover where people use their BTC and what is changing in the Bitcoin world.

The United States has thrown open its regulatory gates with a seismic shift in policy that promises to lift the veil of uncertainty cast by the prior administration, yet risks drowning Bitcoin’s signal in a cacophony of distractions. President Trump’s executive orders and the SEC’s repeal of stifling accounting rules signal a watershed moment. Undoubtedly, amid the clamor for altcoins, stablecoins, and AI-driven hype, one truth remains unshakable: digital scarcity only happens once. Bitcoin’s relentless march as the apex asset—untethered to political whims or copycat protocols—faces its greatest test yet. Will America’s crypto reckoning uplift or fracture focus?

This week, we explore changes in the U.S. regulatory regime, 2024’s mining metamorphosis, and why 2M BTC sold by shadow whales hasn’t sunk prices. Plus, Corn’s ICO revival and Alkanes add to the pile of Bitcoin smart contract options. Buckle up.

Here’s this week’s rundown:

📜 Feature Piece: Digital Scarcity Only Happens Once

🇺🇸 The United States is Open for Business

⛏️ 2024 Bitcoin Mining in Review

💎 How Bitcoin Long Terms Holders Dictate Supply & Demand

🌽 Corn ICO

⚡ ALKANES: More Smart Contracts to Bitcoin

Feature Piece: Digital Scarcity Only Happens Once

History is one long chronicle of near-misses and pretenders to the throne. People loved to pit VHS against Betamax, and some dared to argue that margarine could dethrone butter. Someone looked at Facebook and thought "what if we made this, but worse?" and created Google+. But history is unkind to silver medalists—eventually, the market ruthlessly converges on the one. Gold didn’t win because it sparkled; it won because you couldn’t print it, breed it, or wish it into existence. Scarcity, real or perceived, is the ultimate arbiter. Which brings us to the internet.

The internet was built to copy. It’s a machine for replicating information—emails, JPEGs, Wikipedia entries—at lightspeed. But what about value? Value needs scarcity, and you can’t “Ctrl+C, Ctrl+V” scarcity. For decades, this was the internet’s dirty secret: it could move trillions in wealth, but it couldn’t store wealth. Banks and PayPal became digital Fort Knoxes, but they were just IOU systems. The internet itself remained a desert for value. Then came Bitcoin. For the first time in digital history, something couldn't be copied. Well, technically it could kind of be copied (looking at you, Bitcoin Cash), but the copies didn't matter.

The key insight here – and this is where it gets delightfully recursive – is that digital scarcity itself can only be invented once. Once you've created a system where digital things can't be copied, making another system where digital things can't be copied is just... copying the first system. It's like claiming you've invented a new kind of zero.

(A brief aside about zeros: they're quite useful in mathematics, but we've never needed a second version. One concept of "nothing" has served us remarkably well.)

Now, I learned this the hard way, as most of us do. There's a certain rite of passage in crypto where you convince yourself that surely, SURELY, some other token must also be valuable. After all, it has smart contracts! Or it's faster! Or it's endorsed by a guy who was once in a YouTube video with Elon Musk's cousin's dog walker!

Here's the thing about money: it has the mother of all network effects. A network effect describes how a platform gains value as more participants join. More telephones mean more people you can call. More Facebook users mean a more interesting feed. With money, the network effect is even stronger.

Through millennia, humans experimented with everything from shells to livestock to salt as money. Eventually, gold outlasted them all because it was the hardest to create more of. That scarcity gave gold its monetary dominance, and, in time, almost all other commodities were edged out. A single network effect—one, big, global shelling point—emerges for money. Bitcoin, with its strictly limited supply and decentralized security, is now claiming that role in a digital world. To compete with Bitcoin, you need a team, funding, and marketing. But having those things makes you centralized, which makes you not Bitcoin, which means you can't compete with Bitcoin.

When you put real money on the line, ask yourself which network effect others will choose. Bitcoin’s circle towers above the rest, and the logic of network effects points to continued consolidation. You can wait, but the rest of the world is making the same calculation every day.

BitcoinFi Updates

The United States is Open for Business

Newly elected United States President Donald Trump appears to be keeping his promise, as he makes a splash before the first week in office is even over. In a sweeping executive order signed January 23rd, President Trump established the Presidential Working Group on Digital Asset Markets while explicitly prohibiting the development of a central bank digital currency (CBDC). The order emphasizes protecting individual rights to access public blockchain networks and promotes the development of dollar-backed stablecoins, marking a sharp departure from previous administrative policies. The working group, to be chaired by a Special Advisor for AI and Crypto, will include leaders from key federal agencies and has been tasked with delivering regulatory framework recommendations within 180 days.

Meanwhile, the SEC rescinded Staff Accounting Bulletin 121 (SAB 121), a contentious 2022 policy requiring firms to treat user-held crypto as liabilities. Spearheaded by Commissioner Hester Peirce’s new crypto task force, this reversal aligns with calls for fairer accounting standards. Critics, including Peirce, had long argued SAB 121 stifled institutional participation. The move follows President Biden’s 2024 veto of a bipartisan resolution to overturn the guidance, which Trump’s administration has now effectively nullified.

2024 Bitcoin Mining in Review

Hashrate Index released its full Bitcoin mining in-review report, and the findings show an industry grappling with a transformative year. 2024 was marked by the fourth halving, surging institutional adoption via spot ETFs, and regulatory shifts under a pro-crypto U.S. administration. Despite Bitcoin’s 120% price rally to over $100k, mining economics faced pressure as hashprice fell 45% post-halving, squeezing margins for older ASICs. Network hashrate grew 52% to 803 EH/s, driven by next-gen hardware deployments, while transaction fees dropped 33% after a brief Q2 spike from Ordinals and Runes. Geopolitical developments, including U.S. regulatory clarity and El Salvador’s IMF-backed Bitcoin strategy, reshaped global mining dynamics, with the U.S. retaining 36% of hashrate dominance. Energy markets saw miners balancing cost efficiency with AI/HPC competition, while forward hashrate markets surged 500% as hedging tools gained traction.

Looking ahead, 2025 is poised for continued evolution. Hashrate growth is expected to slow but remain competitive, with energy-adjusted efficiency becoming critical as miners face potential hashprice lows of $30/PH/s. Regulatory tailwinds, including FASB’s fair-value accounting rules and bipartisan U.S. proposals for a Bitcoin reserve, may further institutionalize mining. Meanwhile, AI/HPC demand could drive hybrid data center strategies, and ASIC tariffs or hyperscaler acquisitions may disrupt supply chains. For more details, be sure to check out Hashrate Index’s full report.

How Bitcoin Long Terms Holders Dictate Supply & Demand

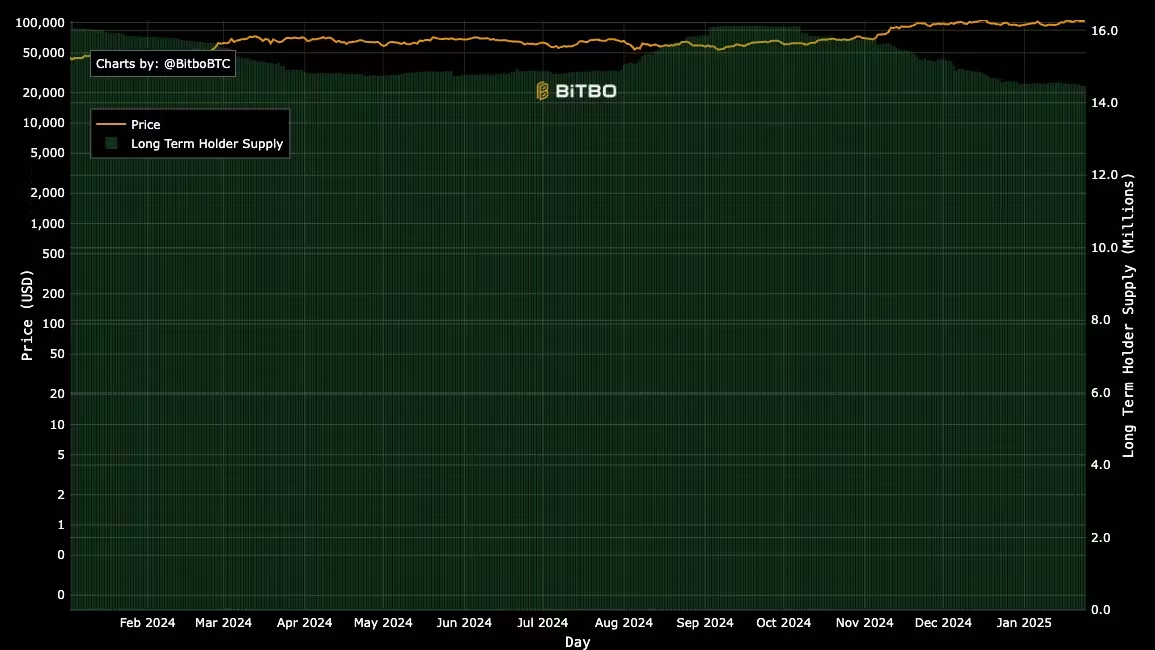

To understand why significant Bitcoin purchases from ETFs and major buyers like Michael Saylor aren't moving the market as much as one might expect, we need to examine the broader supply and demand dynamics at play. The key lies in understanding the role of Long-Term Holders (LTHs) and how they influence Bitcoin's market structure. Long-Term Holders, defined as addresses holding Bitcoin for more than 5 months, have historically controlled a massive portion of Bitcoin's circulating supply. Earlier this year, when Bitcoin was trading around $30,000, these holders had accumulated over 82% of all Bitcoin in circulation – a record high. This accumulation occurred as they followed their typical pattern of buying during market weakness.

The scale of LTH activity dwarfs even the largest institutional buyers. During Bitcoin's rise from $58,000 to over $100,000, these long-term holders released approximately 2 million BTC into the market – equivalent to roughly $200 billion in value. This creates an important context for understanding recent market movements. When we look at the recent purchases – approximately 19,000 BTC between ETF flows and Saylor's acquisition (roughly $2 billion in value) – we need to compare this to the available supply from LTHs. The $2 billion in buy pressure represents just 1% of the $200 billion in potential sell pressure that LTHs have created during this period.

This stark difference helps explain why that relatively modest chunk of demand isn’t moving the market, but it also raises the bigger question of why BTC hasn’t dropped despite such large sell pressure from LTH. The prevailing theory is that most of these significant trades are flowing through over-the-counter (OTC) channels rather than standard exchanges, diffusing the price impact. It suggests that while LTH supply is still formidable, there’s strong enough demand behind the scenes to absorb $200 billion in BTC selling without sending prices sharply lower.

Corn ICO

Are we finally seeing the return of the old guard? Corn seems to think so, as they have raised $8.3 million in a MiCA-compliant token sale that was seven times oversubscribed. Built on Arbitrum Orbit, Corn uses wrapped Bitcoin (BTCN) as its native asset for staking, fees, and yield generation. Unlike the opaque, insider-dominated ICOs of the past, Corn used Legion, a regulated platform requiring KYC and merit-based vetting (via linked wallets, GitHub, and X accounts) to prioritize crypto-native investors.

As a result, we witnessed no side deals, uniform terms for all investors (from retail to VC giants like Polychain), and compliance with EU’s MiCA framework.

ALKANES: More Smart Contracts to Bitcoin

Alkanes is a newly unveiled metaprotocol designed to bring full-scale smart contracts to Bitcoin’s base layer (L1). Built atop Runes and powered by Rust-compiled WebAssembly (WASM), Alkanes enables developers to deploy on-chain applications—such as automated market makers, staking products, and stablecoins—secured by Bitcoin’s network. This approach leverages Protorunes for encoding contract calls and Metashrew for indexing and execution, effectively offering a parallel to Ethereum’s smart contract framework without sacrificing Bitcoin’s trustless security model.

Key features include a UTXO-based architecture for contract state, direct on-chain storage of WASM contract code, and the ability for contracts to interact with each other via OP_RETURN outputs. While still in an early, experimental stage, Alkanes provides open tooling and documentation for developers looking to experiment.

Closing Thoughts

In the end, destiny grants us no abundance of second chances. Like the great dualities of nature – light and dark, truth and falsehood – there exists a singular moment of genuine scarcity in our crypto age amidst an ocean of infinite replication. Bitcoin is the kind of finality the world’s monetary experiments have always yearned for and rarely attained. All the alternatives that follow, no matter how ingeniously conceived or lavishly funded, echo like shadows against the cave wall of that first, singular breakthrough. The market understands this truth in its bones, even as our minds chase newer, shinier illusions. But time strips away pretense, leaving only what is real, what is scarce, what cannot be copied. In Bitcoin's digital scarcity, we have found not just a new form of money, but a mirror reflecting an ancient truth: that which is truly precious comes not twice into the world.

Thank you for tuning in to this week’s BitcoinFi Weekly. See you next week.

If there's a topic you’d like us to cover or have questions, reach out at [email protected].

Learn more about Mezo at the following channels:

👾 Discord: https://discord.mezo.org

🕊 X: https://twitter.com/MezoNetwork

🖥 Website: https://mezo.org

🏦 Deposit Portal: https://mezo.org/hodl

ℹ️ Docs: https://info.mezo.org