Recapping the State of Bitcoin 2024

As the year ends, Thesis has compiled a comprehensive State of Bitcoin 2024 Report, encapsulating the defining moments, technical milestones, and global adoption trends that shaped Bitcoin's landscape this year.

Welcome to BitcoinFi Weekly. We cover where people use their BTC and what is changing in the Bitcoin world.

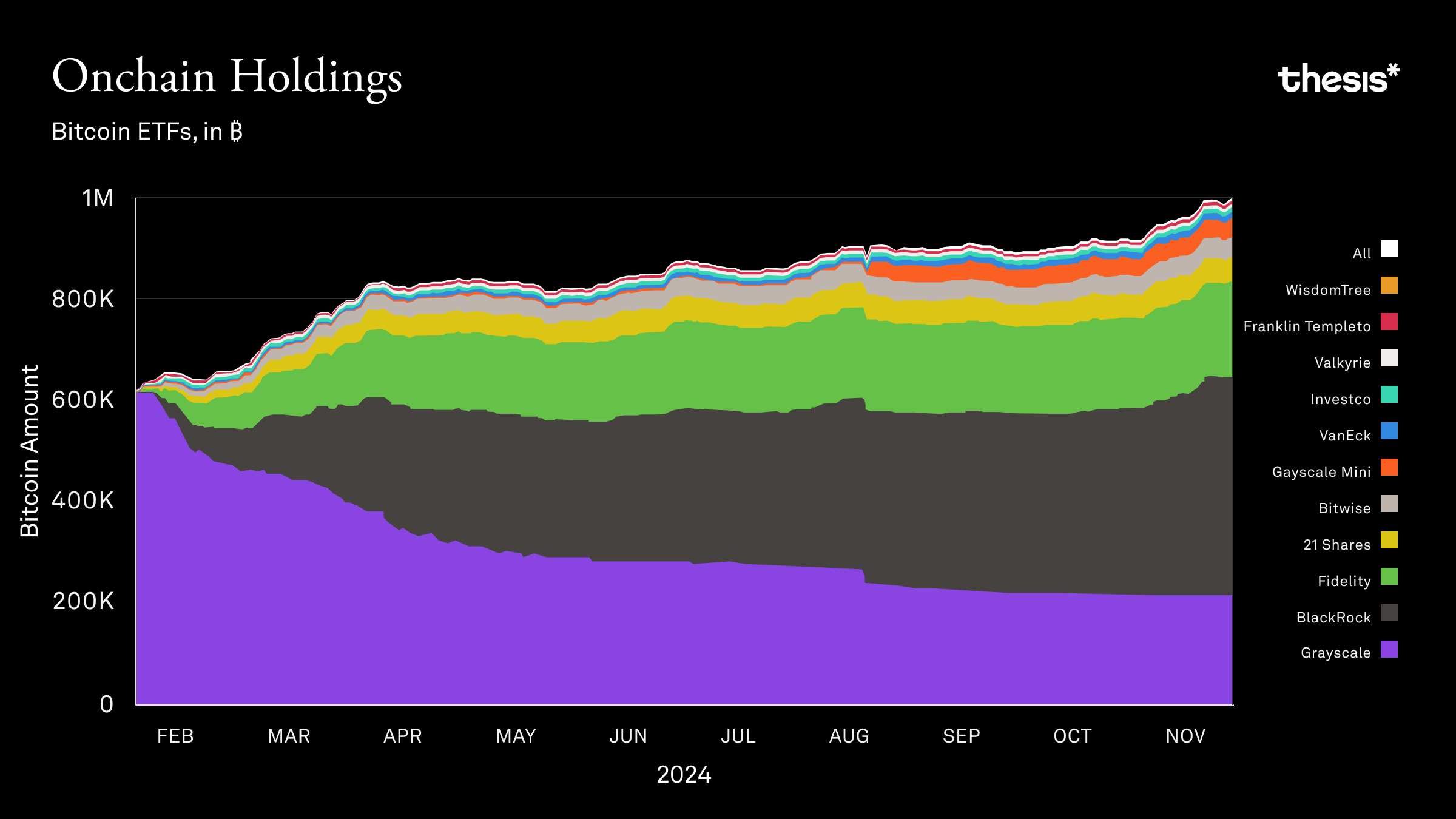

2024 marked Bitcoin's definitive breakthrough into mainstream finance, highlighted by the approval of 11 Bitcoin ETFs with BlackRock's iShares Bitcoin Trust ($IBIT) reaching an unprecedented $10 billion in assets within weeks - a milestone that took gold ETFs decades to achieve. This institutional embrace made Bitcoin accessible to 62% of Americans through standard brokerage accounts, transforming it from a fringe asset into a legitimate financial instrument. The integration triggered heated debates within the crypto community, as the "not your keys, not your coins" ethos increasingly competed with the convenience of institutional custody.

As the year ends, Thesis has compiled a comprehensive State of Bitcoin 2024 Report, encapsulating the defining moments, technical milestones, and global adoption trends that shaped Bitcoin's landscape this year. In this edition of BitcoinFi Weekly, we’ll be sharing key highlights from the report, giving you an overview of Bitcoin’s remarkable journey in 2024. For an in-depth look at these developments and more, you can access the full report here.

Here’s this week’s rundown:

₿ Feature Piece: The State of Bitcoin 2024

⚡ sBTC release

👀 Coinbase's Transparency Report

⚛️ Bitcoin in a Quantum Future

🚀 Exodus IPO

🇸🇻 El Salvador Pulls Out of Bitcoin

Feature Piece: The State of Bitcoin 2024

2024 marked Bitcoin's definitive breakthrough into mainstream finance, catalyzed by the approval of 11 spot Bitcoin ETFs. BlackRock's iShares Bitcoin Trust exemplified this institutional embrace by reaching an unprecedented $10 billion in assets within weeks, making Bitcoin accessible to 62% of Americans through standard brokerage accounts. However, this convenience sparked intense debate about centralization versus accessibility, as ETF performance was projected to lag behind spot Bitcoin over time due to management fees. The success of ETFs naturally led to increased interest in making Bitcoin more productive, ushering in the era of Bitcoin staking.

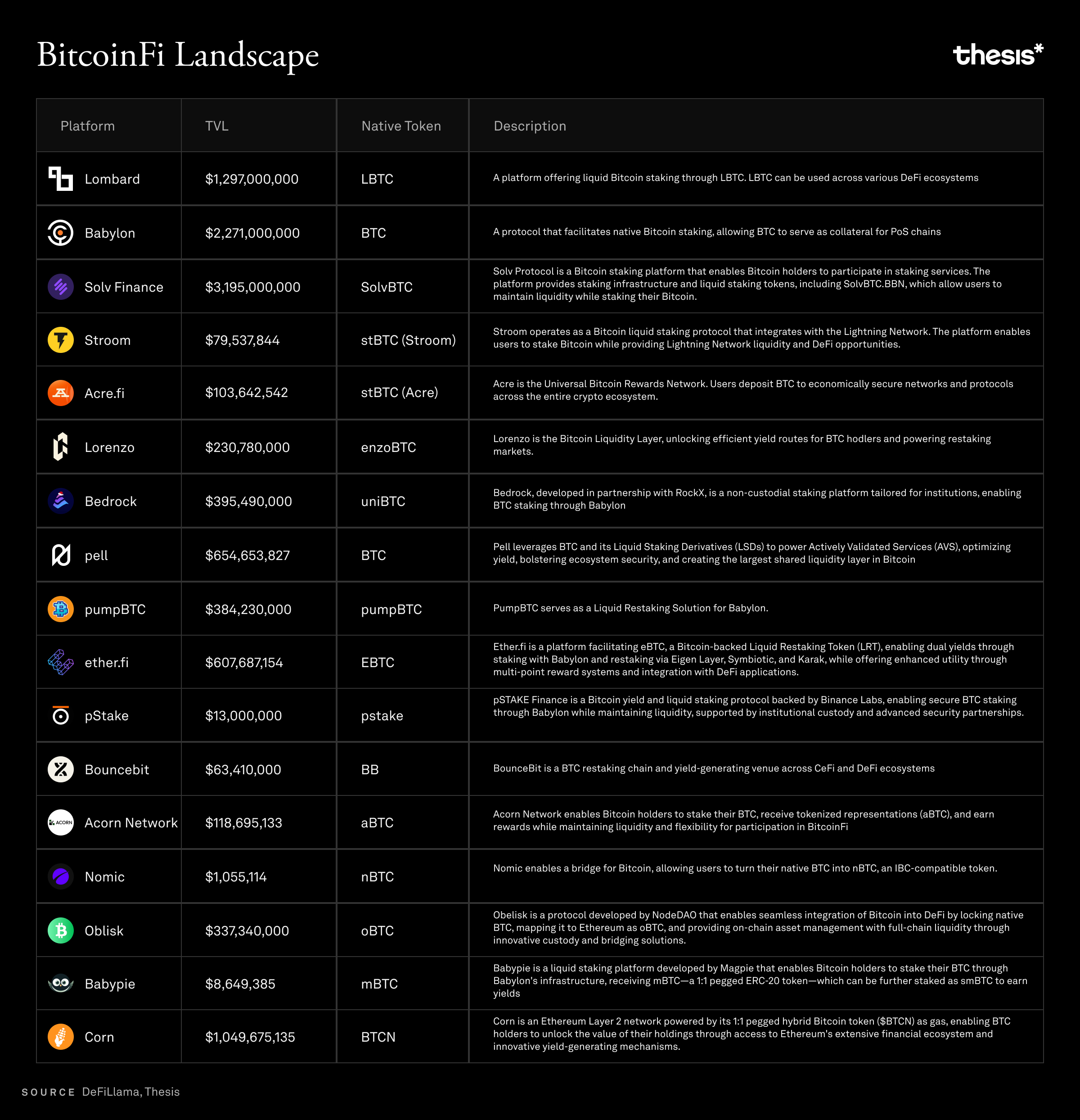

The staking ecosystem flourished in 2024, with platforms accumulating over $10 billion in Total Value Locked (TVL). Major players like Babylon, Lombard, and Solv Protocol emerged with distinct approaches to Bitcoin staking, though each faced unique challenges. While Babylon introduced a marketplace for Bitcoin holders to earn yield by securing Proof-of-Stake chains, Lombard leveraged this framework to offer liquid staking tokens, and Solv created a unified staking system across chains. However, many platforms struggled with technical challenges and trust issues, as yields often depended more on token emissions than sustainable economic activity. As the staking ecosystem evolved, another form of Bitcoin innovation emerged through Ordinals and Runes.

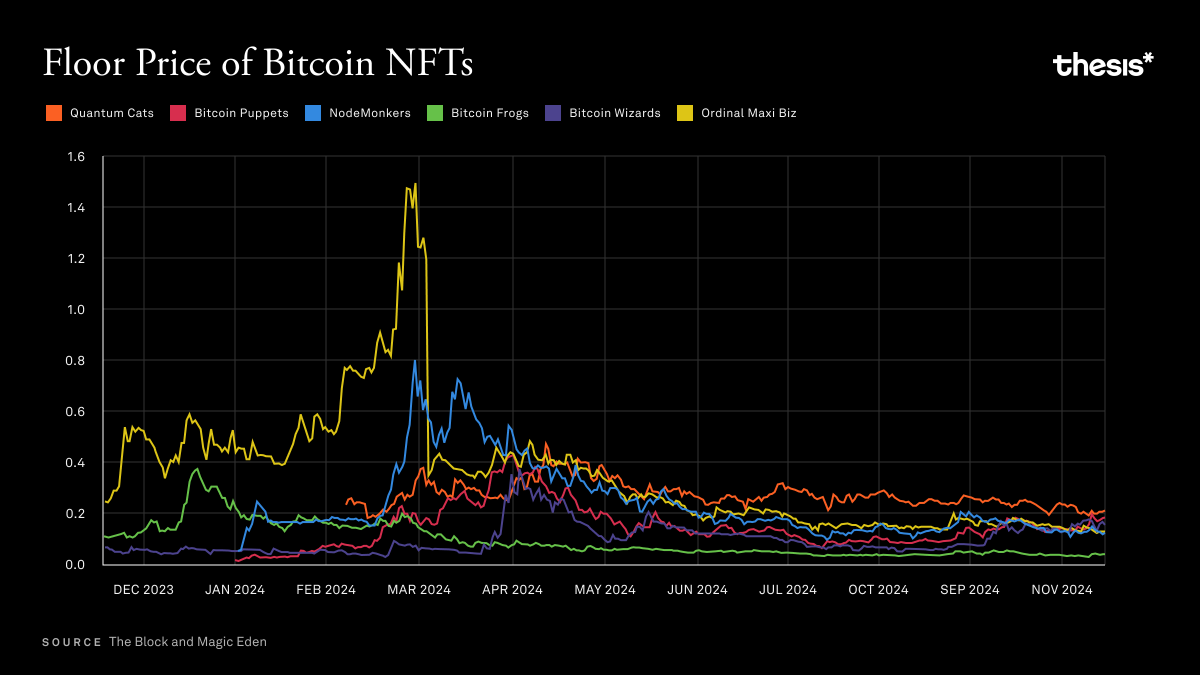

The year witnessed significant shifts in Bitcoin's collectibles ecosystem, with attention cycling between BRC-20s, Ordinals, and Runes. These innovations drove substantial spikes in transaction fees and network activity, though their long-term sustainability remained questionable. While the debate between Bitcoin purists and innovators intensified, research showed inscriptions' impact on blockchain size was minimal. This experimentation with Bitcoin's base layer capabilities led to broader discussions about scalability.

2024 brought major advances in Bitcoin's programmability through innovations like BitVM, the revival of OP_CAT, and various Layer 2 solutions. Citrea emerged with its rollup implementation, Core introduced the Satoshi Plus consensus mechanism, and BOB developed optimistic sequencing. The Lightning Network matured significantly, reaching 5,380 BTC capacity while showing improved efficiency despite operating with fewer channels. This focus on scaling solutions coincided with growing interest in tokenized Bitcoin across other networks.

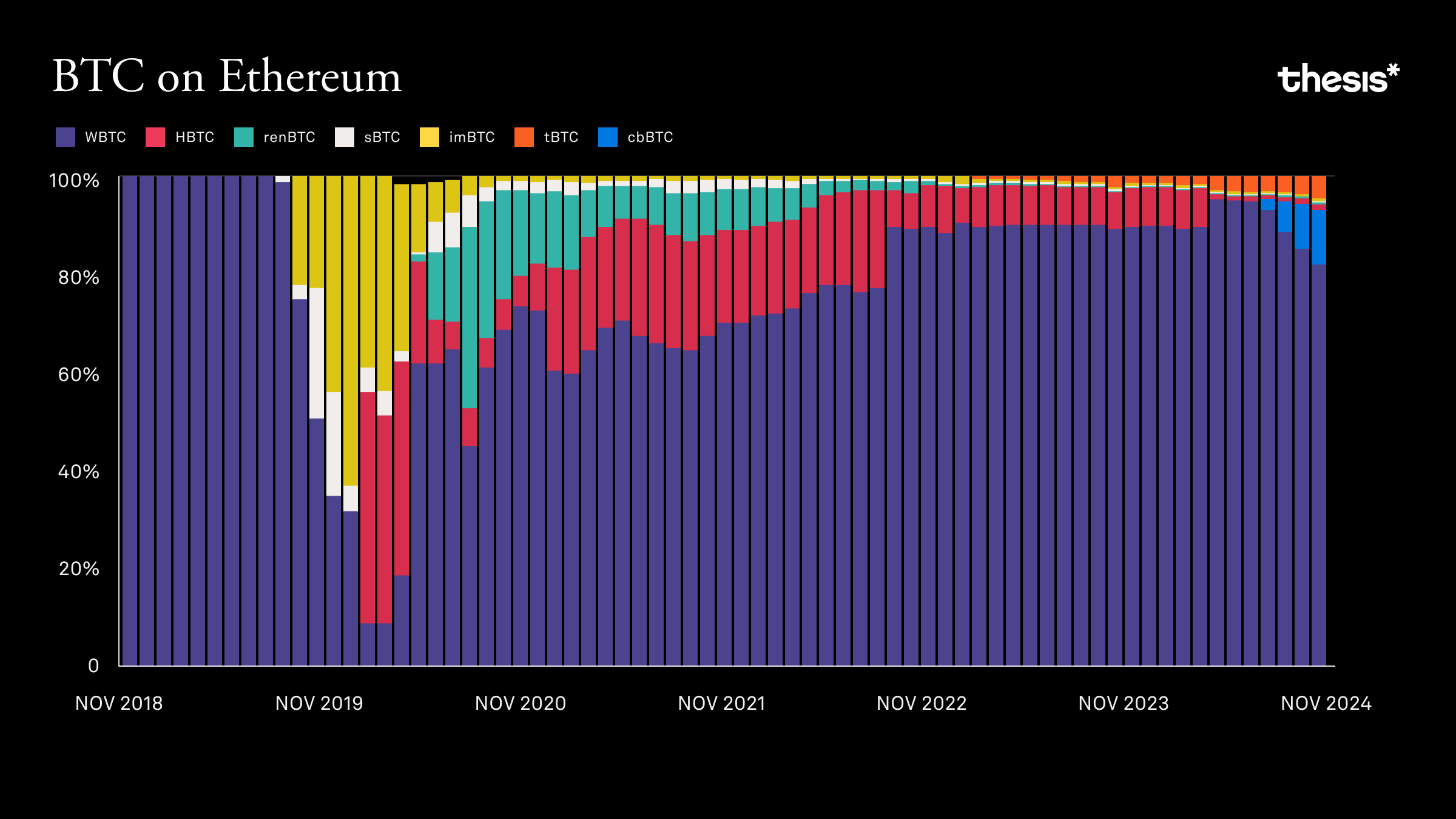

Perhaps surprisingly, while Bitcoin L2s generated considerable excitement, the majority of actual Bitcoin DeFi activity occurred on Ethereum and EVM chains, where tokenized Bitcoin represented 25% of all DeFi TVL. WBTC's long-standing dominance faced challenges following custody changes, creating opportunities for alternatives like tBTC to gain traction. This trend revealed that Bitcoin holders were primarily interested in borrowing against their holdings and earning yield through established DeFi protocols, suggesting that the future of Bitcoin's utility might lie in a combination of native scaling solutions and cross-chain integrations.

For a comprehensive analysis of Bitcoin's transformative year, we invite you to read Thesis's full State of Bitcoin 2024 report. This extensive research piece covers every major development that shaped Bitcoin's journey this year, from institutional adoption through ETFs to technical innovations in the protocol layer. You can find the complete report here.

BitcoinFi Updates

sbtc release

The launch of sBTC on the Stacks mainnet introduces a federated system for minting Bitcoin-backed SIP-010 tokens that enable BTC holders to participate in DeFi applications while maintaining their Bitcoin exposure. The initial release enables Bitcoin deposits with a 1,000 BTC cap and features a trust model based on 15 community-elected signers (known as the sBTC Signer Set), requiring 11 signatures to validate transactions. The system manages deposits through a single UTXO on the Bitcoin blockchain that holds the entire BTC balance pegged into sBTC, with transaction processing times of approximately 3 Bitcoin blocks for deposits.

Notable features include 1:1 Bitcoin backing through the SIP-010 token standard, complete Bitcoin finality through the Nakamoto upgrade, and potential earnings of ~5% annual Bitcoin rewards paid in sBTC biweekly. The system is supported by the Emily API, which serves as a programmatic liaison between users and signers while helping facilitate and supervise the sBTC Bridge.

While the current implementation isn't fully decentralized or permissionless, it improves upon previous centralized solutions by distributing trust across multiple institutional operators with reputational stakes. The sBTC Signer Set has full access to the sBTC UTXO and can rotate their private keys. The project has outlined a phased rollout plan, with Bitcoin withdrawals (estimated to process within 6 Bitcoin blocks) scheduled for March 2025 and further decentralization planned in subsequent phases.

Industry reviewers, including Januz, have praised the transparency of the signer election process and the openly disclosed signer set, while acknowledging that the system currently operates as a federated model rather than a truly decentralized two-way peg.

Coinbase's Transparency Report

Coinbase's sixth annual Transparency Report, covering October 2023 through September 2024, reveals a total of 10,707 government and law enforcement requests, marking an 18% decrease from the previous year.

The report shows that 51% of requests came from outside the United States, with six countries (US, Germany, UK, France, Spain, and Australia) accounting for 81% of all law enforcement requests. Notable trends include significant decreases in requests from several major countries, including Germany (from 1,906 to 1,269) and the UK (from 1,416 to 784), while Singapore saw a substantial increase of 221% (from 34 to 109 requests).

Bitcoin in a Quantum Future

Google's recent announcement of their Willow quantum chip has reignited discussions about quantum computing's potential threat to Bitcoin, though some experts suggest this specific development isn't cause for immediate concern.

In general, quantum computing poses two distinct risks to Bitcoin: breaking public/private key cryptography of existing addresses and compromising the SHA256 mining algorithm, with the former being the more immediate concern.

The threat manifests in two forms: "short-range" attacks targeting in-flight transactions within the 10-minute block window, and "long-range" attacks that could derive private keys from public addresses of stored bitcoin. Different Bitcoin address types have varying levels of quantum vulnerability, with older standards like Pay-to-Public-Key (notably used by Satoshi's dormant coins) being most susceptible, while surprisingly, even newer standards like Taproot (P2TR) remain significantly vulnerable.

Developer Hunter Beast has proposed the first Bitcoin Improvement Proposal (BIP-360) for quantum resistance, introducing Pay-to-Quantum-Resistant-Hash as part of a potential "QuBit" soft fork, though this would require increasing transaction sizes and adjusting block weight calculations. While the exact urgency remains uncertain, experts suggest a rough timeline of 10 years before quantum computing becomes a critical threat, though implementing solutions through soft forks could take several years of community discussion and coordination.

Exodus IPO

Exodus ($EXOD) has made history as the first U.S. company to have its stock represented onchain while trading on the NYSE American. The company, which develops one of the oldest operating crypto wallets, received approval to list its common stock on the NYSE American in May 2024, following its transition from OTC Markets. Ecodus had a successful 2021 mini IPO that raised $75 million, engaging over 6,800 retail investors through broker-dealer tZero. Initially opening at $60 per share with an implied market capitalization of $1 billion on Securitize Markets, the stock rose over 37% and reaching an all-time high of $64.50 before settling around $53.

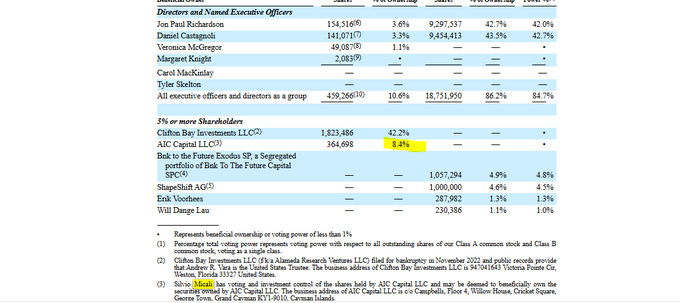

EXOD stock is tokenized on the Algorand blockchain through Securitize, allowing investors to hold tokens directly in their Exodus wallets. This enables potential features like USDC dividend payments and blockchain-based corporate governance. Notably, Algorand's founder, Silvio Micali, holds an 8% interest in Exodus stock.

Exodus's financial performance shows $20.1 million in revenues with a net loss of approximately $800,000 in Q3 2024, with revenue streams primarily from exchange services, fiat onboarding, staking, and consulting services. The company has expanded its ecosystem through strategic partnerships with Ledger and Magic Eden.

CEO and co-founder JP Richardson emphasized that the NYSE American listing will enhance stockholder value by increasing their presence in the investor community and improving liquidity. The stock's SEC qualification under Regulation A of the Securities Act enables regulated capital raising from the public, positioning Exodus uniquely in the intersection of traditional finance and cryptocurrency markets, despite ongoing regulatory scrutiny of the crypto sector.

El Salvador Pulls Out of Bitcoin

The International Monetary Fund (IMF) has reached a $1.4 billion loan agreement with El Salvador, requiring the country to modify its pioneering Bitcoin policies. The deal involves three key changes: making Bitcoin acceptance voluntary for merchants rather than mandatory, restricting public sector involvement in Bitcoin-related activities, and gradually winding down the government's role in the Chivo digital wallet program. While El Salvador will also no longer accept tax payments in Bitcoin, President Nayib Bukele has maintained the country's commitment to continue purchasing 1 BTC daily. The agreement comes at a time when Bitcoin has reached record highs around $100,000, with El Salvador's government reporting significant gains on its Bitcoin holdings that were initially purchased at around $30,000.

The IMF deal, which needs executive board approval, is a compromise between El Salvador's crypto-friendly stance and the IMF's traditional financial oversight role. El Salvador's pivot in its Bitcoin strategy reflects a broader geopolitical reality: the nation's early-mover advantage in Bitcoin adoption has been overshadowed by the entrance of more economically powerful nations. While El Salvador pioneered government Bitcoin adoption in 2021, its appeal as a Bitcoin-friendly jurisdiction has diminished as countries with more robust financial infrastructure and regulatory frameworks – notably the United States, Singapore, and the UAE – have embraced cryptocurrency innovation. President Bukele's pragmatic decision to modify Bitcoin policies in exchange for IMF funding suggests a recognition that El Salvador's competitive advantage in attracting Bitcoin capital and talent cannot solely rely on friendly legislation when competing against nations with superior economic resources, sophisticated financial markets, and more developed technological ecosystems.

The agreement is expected to unlock additional funding from development banks, potentially bringing the total financing package to over $3.5 billion, while helping address El Salvador's debt, which peaked at 85% of GDP in 2024.

Closing Thoughts

Looking ahead to 2025, Bitcoin appears poised for significant evolution across multiple fronts. The maturation of Bitcoin ETFs and institutional adoption will likely continue to drive mainstream acceptance, while the full impact of Trump's crypto-friendly administration could reshape the regulatory landscape. The various Layer 2 solutions and scaling technologies introduced in 2024 – from BitVM to rollups and sidechains – should begin bearing fruit, hoping to solve some of Bitcoin's long-standing scalability challenges.

For a comprehensive analysis of Bitcoin's transformative year, we invite you to read Thesis's full State of Bitcoin 2024 report. This extensive research piece covers every major development that shaped Bitcoin's journey this year, from institutional adoption through ETFs to technical innovations in the protocol layer. You can find the complete report here.

Thank you for tuning in to this week’s BitcoinFi Weekly. See you next week.

If there's a topic you’d like us to cover or have questions, reach out at [email protected].

Learn more about Mezo at the following channels:

👾 Discord: https://discord.mezo.org

🕊 X: https://twitter.com/MezoNetwork

🖥 Website: https://mezo.org

🏦 Deposit Portal: https://mezo.org/hodl

ℹ️ Docs: https://info.mezo.org